The ultimate way to know for sure if you are on top of your business is to know where the money is going at all times. Not fully understanding your cash flow 101 starts a domino effect. And is, in fact, one of the recognized leading causes of business failure.

Many business owners have been fooled into a safe sense of security because their business is profitable.

Their P&L statement shows that they are profitable and they have checked their product margins, and they are also healthy. The reality is, even if you are profitable and your margins are good, Cash Flow is the evil cousin of these metrics. Ignore this cousin and your business risks failure.

So how do you figure out where your company’s revenue is going and where it’s coming from, and what systems do you need to set in place to manage this?

Let’s start with the Cash Flow Statement (CFS)

Also known as the statement of cash flows, it’s one of the main statements in financial and managerial accounting. It provides an overview of business results— together with the income statements and balance sheets.

But how do you prepare a cash flow statement? And what does it include?

In this article, we will get down to the nitty-gritty of cash flow statements, so that you can determine your business standings. (And if you can really afford that fancy coffee machine for your business break room.)

Cash Flow

The NET amount of money moving in and out of your business is the basic definition of cash flow. It shows how the cash is being used and where it comes from.

A positive cash flow happens when your inflows are greater than your cash outflows. If it’s deemed negative, then your business is in danger of not having enough cash to finance operations. Of course, this still depends on your financial reserves. To alleviate the situation, many businesses, then become committed to borrowing to keep them running.

So how do you determine the cash flow?

With the statement of cash flow, of course.

Check out my three tips for effective cash flow management.

Statement of Cash Flows

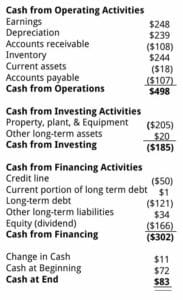

Cash flow statements help analyze financing, operating, and investing activities. It’s to showcase where your business cash is being spent and where it’s coming from. This statement allows creditors or investors to assess your business’ ability to fulfill obligations.

In addition, it shows them your capabilities to produce future inflows of net cash while deciding the need for external financing. When creating a CFS, I prefer to break the exercise down into the primary categories of operating, investing and financing activities.

By following these steps, I am better assured of not omitting any important amounts.

OPERATING ACTIVITIES.

Only included if the CASH PAYMENT happened during the accounting period the statement reports on. This consists of operating and revenue expenses such as from customers or projects.

INVESTING ACTIVITIES.

Covers purchasing property, manufacturing equipment or plant. Acquisition of a business may be included as well.

FINANCING ACTIVITIES.

Involves repurchasing or selling of stocks, issuing shares, and paying dividends and debts.

Preparing a Statement of Cash Flows

- Calculate:

- Net cash flow from operating activities.

- Net cash flow from investing activities.

- Lastly, Net cash flow from financing activities.

- Combine net cash flows from all the activities above.

Once the net cash flows from the activities are calculated and combined, you’ll see the net cash increase or decrease for the period.

The net of these changes should be equal to change in cash on the balance sheet. There are three main cash flows you need to be aware of:

Operating Cash Flow

A.K.A the OCF or CFO, the operating cash flow is the first part of the cash flow statement. It determines the revenue-generating aspects of your business.

You can use the formula below to calculate it:

Total Revenue (TR) – Operating Expenses (OE) = OCF

In order for your company to be successful, long-term inflows must be greater than outflows. If it’s the other way around, at some point in time your business will need additional financing.

Free Cash Flow

The cash generated less the cost of expenditure on assets is what comprises free cash flow. Free cash flow is calculated as:

Net Cash Flow from operating activities – Capital Expenditures (CE) = Free Cash Flow (FCF)

Free cash flow gives you the amount left after the business pays for capital expenditures and operating expenses. This calculation is crucial since it gauges if your company has enough cash left to pay back investors.

Need help with your cash flow statement?

Discounted Cash Flow

For many business owners, understanding and managing your Discounted Cash Flow (DCF) is not required. However, I am including it here for those that would like to be more aware of why it is often considered. This cash flow is often used to help evaluate a potential investment opportunity, it is typically used to value any of the following:

- Business

- Bonds

- Initiative or Project

- Company shares

The end result shows the return you can expect to earn from the said investment.

Here’s the formula to calculate DCF:

[CF1 / (1+r)1] + [CF2 / (1+r)2] + … + [CFn / (1+r)n] = DCF

CF = Cash flow in the period

n = The period number (months, quarters, or years)

r = discount rate or WACC (In other words, the rate a business expects to pay for its assets)

DCF take into consideration the time value of money. It plays on the concept that a dollar today is worth more than a dollar tomorrow because of its earning potential. In this case, such as the interest rate.

If you pay less than the Discounted Cash Flow value, the return will be greater than the discount rate. However, if you pay more, the return will be less. You will know that a potential investment is likely a good one when the DCF value is higher than its cost.

Get your own Formula Cheat SheetBack to Basics

So do you have a Cash Flow Management System in your business? Ideally, this reporting should be set up so that your balance sheet, profit, and loss, income statements are all interconnected. It should also be fed live data from your accounting program.

But the reality is, that for many business owners, especially in the SME sector, that they neither have nor intend to have this more comprehensive structure. There is a simple, although partial fix to this. I have created a simple Cash Flow model that should become part of your, and your bookkeeper’s weekly task. You can get it here:

Simple Cash Flow ModelThe worksheet is super simple, and for whoever manages this in your business, it should not take them longer than about 15 minutes, once a week to update, and then for you, as the business owner to review.

It is critical that this task is on the highest priority list and you must set the standard that it MUST be completed every week, at the same time and in the same format, every week! This will give you a clear “heads-up” of your cash situation two weeks in advance so that you have additional time to better manage your cash flow and your business.

Wrapping it all up…

Whether you’re trying to determine where your money is going and where it’s coming from or looking for financing or investors, the cash flow is a great tool to use. Knowing your cash flow 101 allows you to see how your cash is moving in and out of your business.

Armed with this cash flow statement guide, I think you will be well-prepared to make informed decisions about the future of your company.

Let’s dig deeper

Recent Comments